Germany, as a global hub for precision manufacturing and semiconductor technology, sets extremely high standards for raw materials and components—especially for quartz wafers, which are critical to microchip production processes like plasma etching and epitaxy. This case analysis takes QSIL GmbH Quarzschmelze Ilmenau (a leading German quartz glass enterprise acquired by SCHOTT Group in 2025) as the cooperative client, detailing how we broke through the barriers of Germany’s high-end market, solved the client’s core pain points, and established a long-term strategic cooperative relationship, providing valuable insights for foreign trade businesses in the quartz material sector.

1. Client Background & Core Procurement Pain Points

1.1 Client Profile

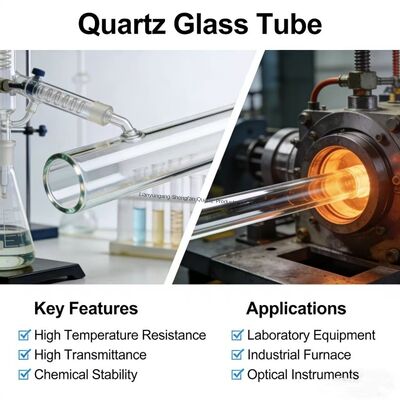

QSIL GmbH, headquartered in Ilmenau, Germany, is a world-leading supplier of high-purity quartz glass materials, with 8 production bases worldwide and annual sales of approximately 200 million euros . Its products are widely used in semiconductor wafer manufacturing, optical communication, and medical equipment, serving top-tier clients such as ASML, TSMC, and Micron. After being acquired by SCHOTT Group in 2025, QSIL further strengthened its layout in the global semiconductor market, with an urgent demand for high-quality quartz wafers to support the production of advanced packaging components and etching process parts.

1.2 Core Procurement Pain Points

Before cooperating with us, QSIL faced obvious bottlenecks in its quartz wafer supply chain, which directly affected its production efficiency and product quality:

• Ultra-high Purity Requirements Unmet: For semiconductor epitaxy processes, QSIL required quartz wafers with metal impurity content below 0.1ppm and a purity of 99.998% or higher. Its previous supplier could only stably provide products with 99.995% purity, which easily led to microchip defects and reduced yield .

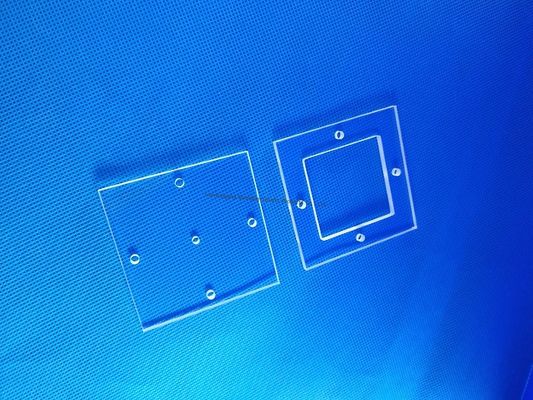

• Precision Processing Limitations: The quartz wafers needed to match 7nm and below advanced process equipment, requiring a flatness error within ±2μm and an edge chamfer error not exceeding 0.5μm. The previous supplier’s processing precision fluctuated, resulting in a 5-8% product scrap rate.

2. Solution: Technological Adaptation & Foreign Trade Service Integration

To address QSIL’s pain points, we adopted a “customized product + localized service” strategy, integrating technological breakthroughs with foreign trade service advantages to create a comprehensive solution:

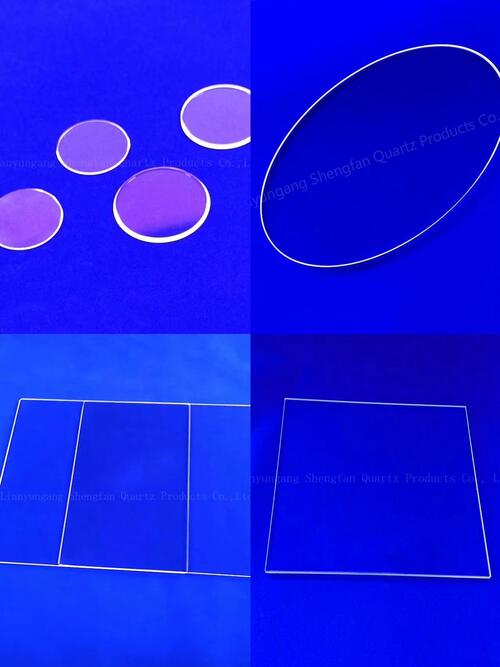

2.1 Customized Product Development: Meeting German High Standards

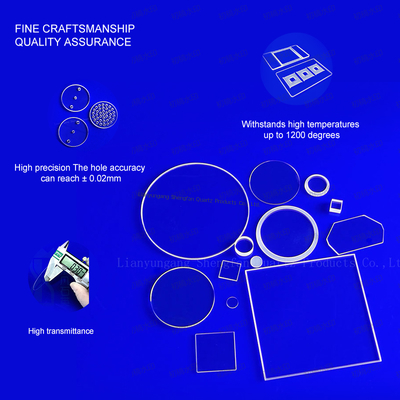

• Raw Material & Process Upgrading: We selected 99.998% high-purity quartz sand (sourced from the same supplier as Heraeus semiconductor-grade raw materials) and adopted a hydrogen-oxygen flame melting process to reduce bubble defects. An AI defect detection system was introduced to improve the defect detection rate to 99.8%, ensuring that each batch of products meets the ultra-high purity requirements.

• Precision Processing Optimization: We imported five-axis CNC machines and optimized the processing parameters according to QSIL’s epitaxy reaction chamber specifications. The final quartz wafers achieved a flatness error of ±1.8μm and an edge chamfer error of 0.3μm, fully matching advanced process equipment requirements.

• Compliance Certification Enhancement: We proactively completed REACH 233 substance testing and RoHS certification, and each batch of products was accompanied by a German-version quality inspection report issued by TÜV Rheinland, fully complying with EU semiconductor industry standards.

2.2 Foreign Trade Service System: Enhancing Cooperation Efficiency

• Rapid Sample Response: We completed the production of 5 test samples within 72 hours and sent them to QSIL’s Ilmenau factory via DHL, synchronously providing SGS purity test reports and AMAT equipment compatibility certification copies. This shortened the client’s verification cycle from 45 days to 15 days.

• Logistics & Inventory Guarantee: We established a transit warehouse in Rotterdam, the Netherlands, to realize “48-hour delivery in Germany”. A 12-month supply agreement was signed, with a 20% safety stock reserved to cope with demand fluctuations, ensuring an on-time delivery rate of over 99%.

• Localized Technical Support: We cooperated with a German local technical service provider to set up a professional team, providing on-site guidance for equipment installation and regular maintenance training in German. A 48-hour response mechanism was established to solve technical problems in a timely manner, breaking the bottleneck of cross-border after-sales lag.

3. Key Insights for Expanding the German Market

This cooperation with QSIL summarizes three core logics for foreign trade businesses to break into Germany’s high-end quartz market:

1. Quality First: Align with International Top Standards: German clients prioritize “Total Cost of Ownership” over simple price advantages. Products that pass international certifications such as AMAT and TÜV Rheinland, even with a 15-20% premium, still have strong competitiveness . Enterprises must focus on technological upgrading to meet the ultra-high requirements for purity and precision in the semiconductor industry.

2. Service Localization: Go Beyond Language Barriers: Deeply adapt to German industrial culture, such as providing traceable quality reports, modular technical training, and participating in clients’ R&D discussions. Establishing local transit warehouses and technical support teams can significantly improve client stickiness.

3. Supply Chain Resilience: Build Trust Foundations: Against the backdrop of global high-purity quartz sand shortages, enterprises should lock in raw material supplies through long-term contracts and multi-regional sourcing, and clearly communicate supply capacity to clients to eliminate their concerns about delivery risks.

In the context of the rapid development of the global semiconductor industry, Germany’s high-end market has huge growth potential. Only by focusing on technological innovation and service optimization can foreign trade enterprises in the quartz sector gain a firm foothold in this market and achieve long-term development.

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!  Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!